.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

How to Know When You Need a Tax Resolution Specialist and How They Can Help

Dealing with tax issues can be one of the most stressful experiences in life. Whether it's a notice from the IRS, a mounting tax debt, or a complex audit, many people find themselves overwhelmed and unsure of how to proceed. Recognizing when you need professional...

How to Prepare for an IRS Appeals Hearing

An IRS appeals hearing can be an intimidating experience, but it’s also an opportunity to resolve tax disputes without going to court. If you’ve received a notice to attend an IRS appeals hearing, preparation is key to achieving a favorable outcome. This blog outlines...

Tax Debt Resolution Options:

Which One Is Right for You? Dealing with tax debt can feel overwhelming. Whether you owe a small amount or a significant sum, finding the right resolution option is essential to avoiding penalties, interest, and enforcement actions from the IRS. Fortunately, there are...

Filing Back Taxes to Avoid IRS Trouble:

A Simple Guide Falling behind on filing your taxes can be a daunting situation. For many, the fear of penalties or the complexity of filing multiple years' worth of taxes prevents them from taking action. However, filing back taxes is a crucial step in avoiding...

About Us

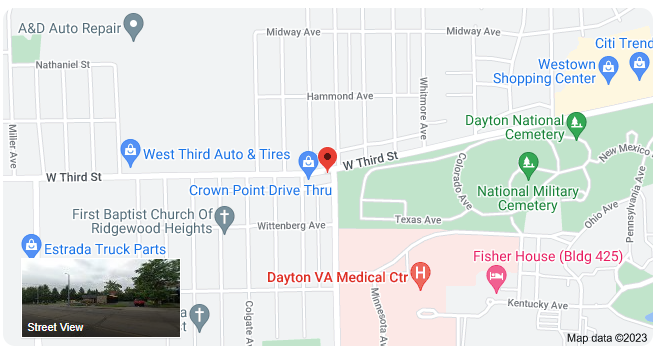

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.